Why the topic is becoming increasingly important

Do you know the ethical practices and decision-making processes of your algorithms? Are your customers’ personal data handled fairly and transparently? Do you have a data ethics framework in place within your company? In the following lines, find out why data ethics is becoming increasingly important for financial services companies.

Well-known companies like Goldman Sachs Group Inc. have been accused of bias and discrimination in the processing of data within their algorithms. As a result, companies like Microsoft and IBM are implementing strategies for artificial intelligence (AI) and data ethics to ensure ethical data handling. Regulatory authorities are increasingly scrutinizing data ethics practices, further emphasizing the

What is data ethics?

Digital risk not only encompasses cybersecurity and data protection but has also expanded into a new area: data ethics. Data ethics involves the examination and evaluation of moral issues related to data, algorithms, and corresponding practices to formulate and reinforce morally sound solutions. In particular, it considers moral obligations in the collection, protection, and use of structured and unstructured data, which can have negative impacts on individuals and communities.

This includes promoting and advocating concepts of right and wrong behavior, transparency, and accountability for actions and decisions made by automated/artificial intelligence (AI) regarding general and personal data. Data ethics is especially important for analysts, data scientists, and information technology experts. All companies that manage, use, and process data must be familiar with the fundamental principles of data ethics.

Data ethics in financial services companies

Recently, the media have increasingly reported on violations of ethical principles. As a result, financial services companies are striving to take a leading role in data ethics. If a financial services company is perceived as careless in handling data, it can have significant consequences, such as loss of customer trust, regulatory investigations, and investor backlash. These risk factors have made data ethics an issue that no financial services company can afford to ignore.

The Avanade Digital Ethics Study from 2020 found that 70 percent of financial service providers plan to increase their investments in data ethics in the coming years. A 2022 HWZ survey on digital ethics in Switzerland revealed that 80 percent of participants across various industries either have or are working on a data strategy with a focus on data ethics. These findings indicate that significant investments in data ethics are being considered as a response to growing digital risks.

Operationalization of data ethics

The ethical handling of data requires a fundamental shift in how data is perceived within companies. While security concerns (are confidentiality, integrity, and availability of data adequately protected?) and data protection (do data controls comply with legal requirements?) remain relevant, the additional consideration of ethics and trust is becoming increasingly crucial.

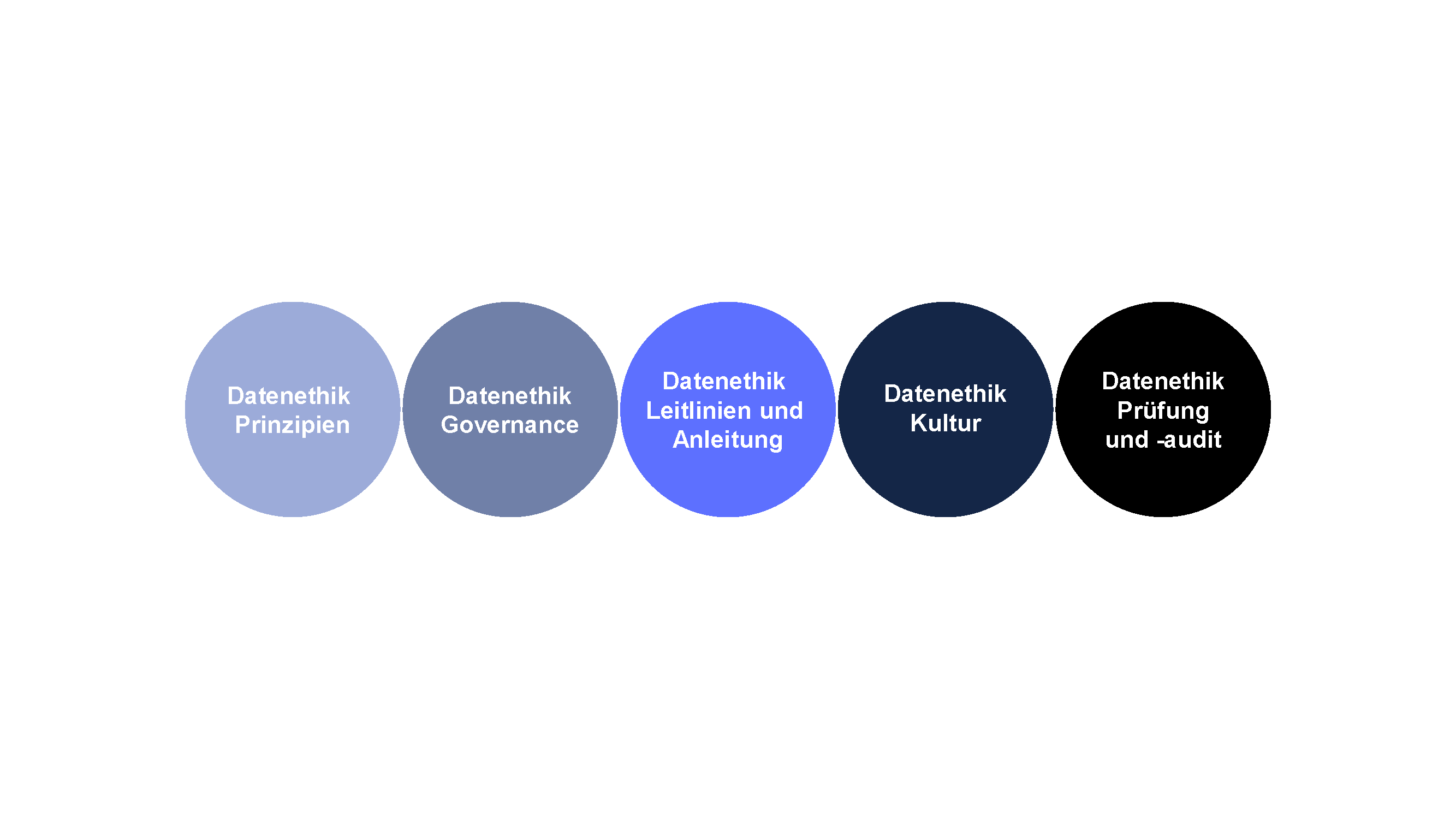

Below are some suggestions on how to operationalize data ethics in financial services companies:

1. Data ethics principles

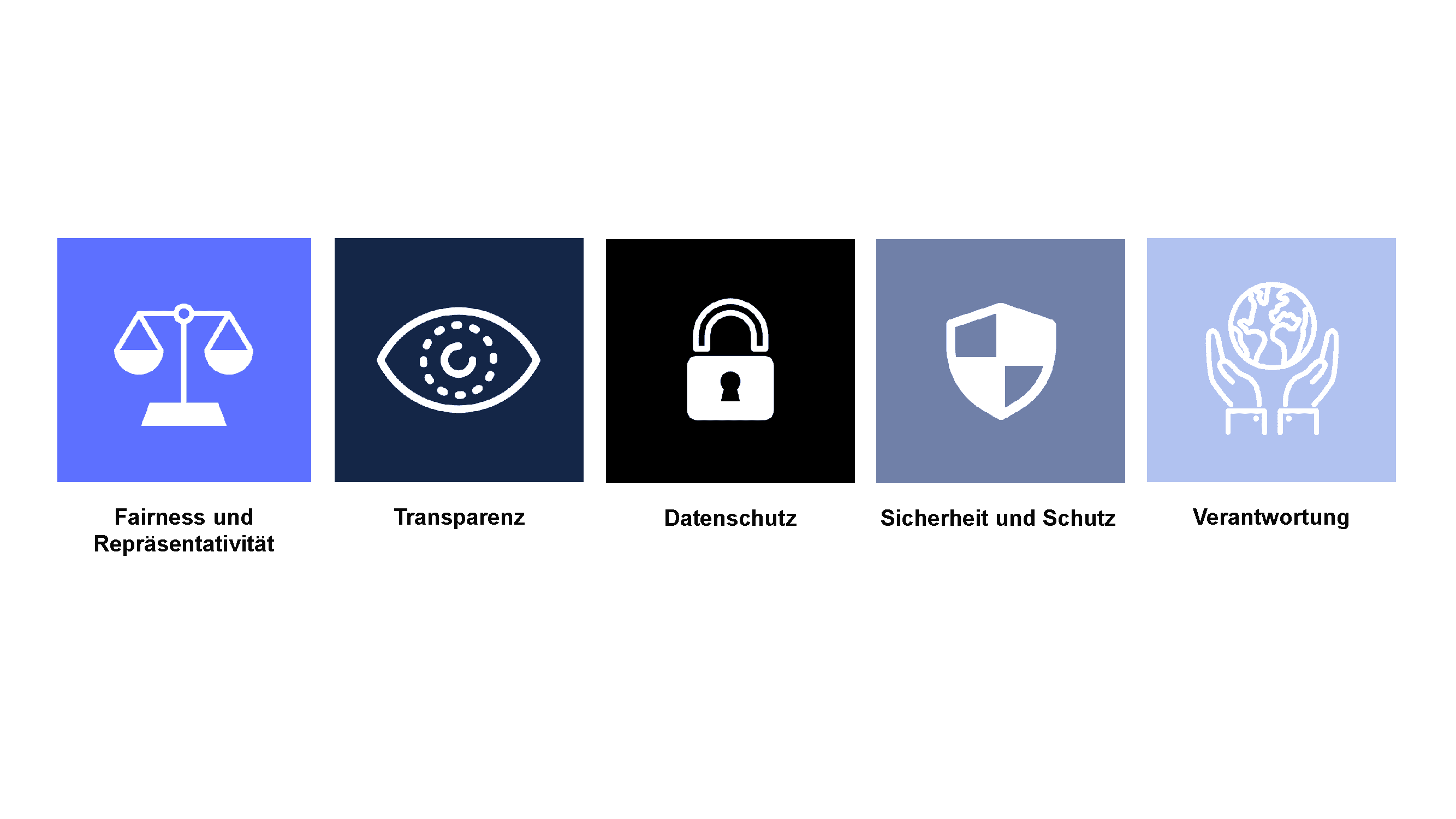

Definition of data ethics principles:

Fairness and representativity

- Effort to reduce unintentional bias

- Use of data with appropriate quality and context

Transparency

- Establishing a common understanding of data ethics and the objectives of the initiative

- Developing a communication strategy (internal and external)

Data protection

- No unlawful or unethical collection of personal data

- Storage of personally identifiable information in a secure database

Protection and security

- Building reliable and resilient data systems/processes against internal and external risks

- Efficient monitoring of data access and procedures for reporting violations

- Use and processing of data in an unbiased and ethical manner

Responsibility

- Employees are responsible for their work

- Consideration of the long-term impact on the organization

2. Data ethics governance

Establishment of a solid and transparent data ethics governance structure:

- Establishment of an ethics board for fundamental questions

- Definition of process responsibilities and role descriptions

- Communication and promotion of data ethics principles

- Training and empowerment of employees

- Consultation or decision-making in sensitive use cases

3. Data ethics guidelines

Formulation of data ethics guidelines:

- Definition of concepts for due diligence regarding data provenance

- Utilization of existing policies and procedures

- Establishment of a code of ethics

- Implementation of best practices for data sharing

- Formulation of guidelines for ethical decision-making

4. Data ethics culture

Promoting a data ethics culture:

- Knowledge transfer and risk- and role-based training at all levels

- Development of a new data ethics toolbox

- Integration into daily operations

- Support for leadership teams

- Shifting compliance from a tick-box approach to values and principles

5. Data ethics audit

Implementation and execution of relevant assessment and audit procedures in the field of data ethics:

- Assessment of data ethics risks and definition of risk mitigation measures

- Approach model for data ethics audits, including classification of the “system criticality” of algorithmic systems

- Evaluation of the implementation of data ethics policies

- Assessment of the concept for employee empowerment

Financial services companies must ensure that data ethics is embedded throughout the organization – from the legal and finance departments to business development – providing a structure that meets the diverse needs of stakeholders.

How can Eraneos support you?

Eraneos can support you in defining a data ethics framework and embedding it within your organization. we can offer our expertise in the following phases:

- Review – we help you assess your current data ethics strategy, including relevant policies, procedures, and concepts.

- Design – we support you in designing and developing an ethical strategy framework that includes principles, governance, guidelines, culture, and auditing in the field of data ethics.

- Monitoring – after establishing your data ethics strategy framework, we assist you in defining and monitoring key performance indicators (KPIs) to measure the adoption and effectiveness of the data ethics strategy.

We have supported various clients in integrating a data ethics framework into their organization, based on the Eraneos framework.

In a recent client project in the banking sector, Eraneos successfully assisted in the development of a data ethics strategy as well as in establishing effective procedures for measuring the feasibility of the ethics strategy. With a clear and precise data ethics strategy for managing data ethics, our client is now better equipped to navigate an ever-evolving regulatory landscape and protect stakeholder interests. This enables increased transparency and trust, which not only strengthens reputation and integrity but also enhances customer acquisition and retention.

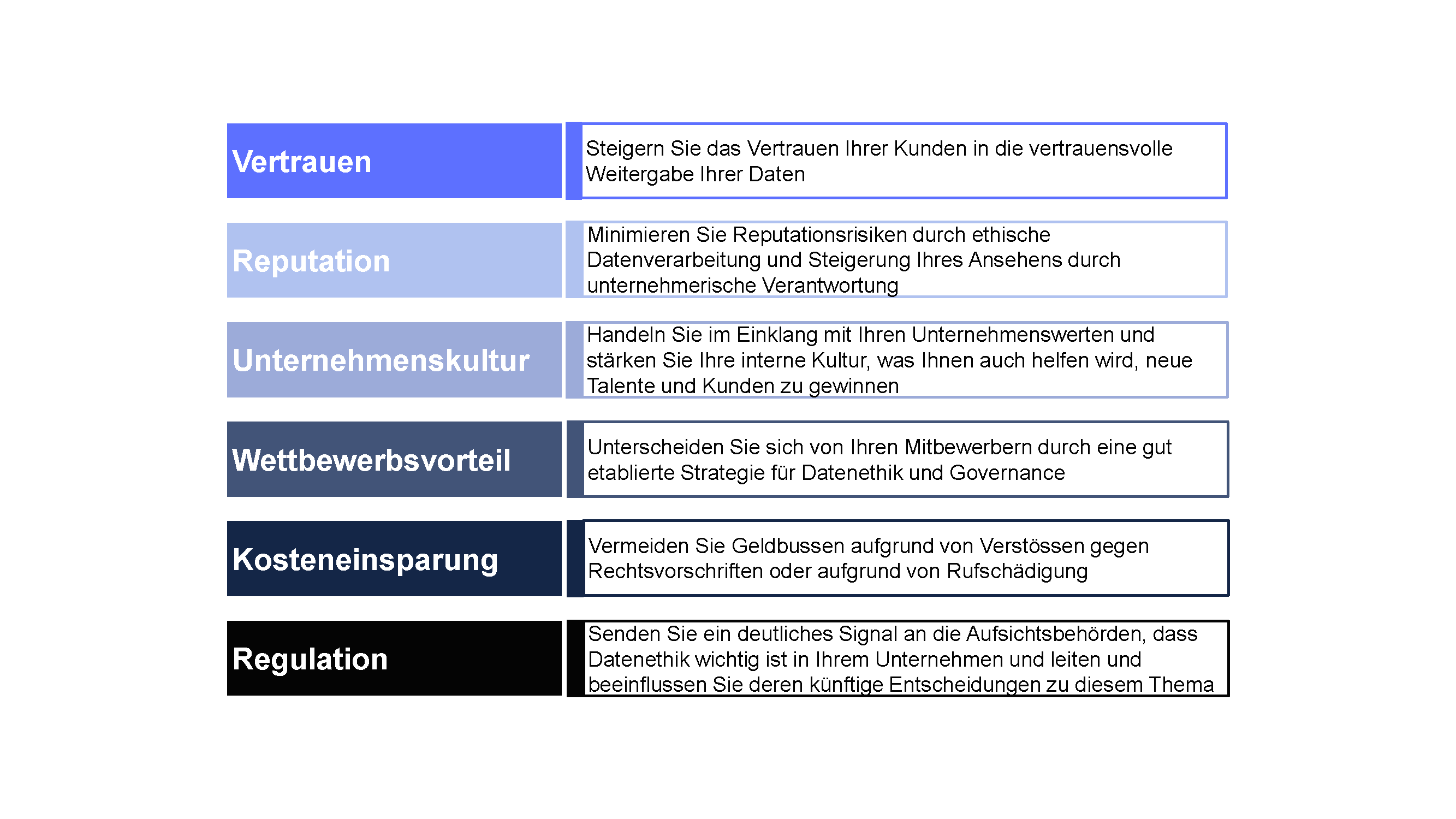

In summary, the following benefits result from this:

Don’t hesitate to discuss the topic of data ethics with our experts.

We are happy to support you in establishing a data ethics framework within your organization.