Make sure that you are ready in time for DORA

The deadline for implementation of the Digital Operational Resilience Act (DORA) is fast approaching. On 17 January 2025, all financial institutions must comply with this European regulation that aims to strengthen the digital resilience of the sector.

Contact our expertsDORA in a nutshell

The Digital Operational Resilience Act (DORA) for the financial sector is EU legislation that went into force on January 16, 2023. Its purpose is to strengthen the resilience of EU financial entities and reduce their vulnerability to ICT risks like IT failures and cyberattacks. DORA tackles such issues by introducing standard security requirements for Information & Communication Technology. The regulation applies not only to the financial sector itself but also to many of the ICT service providers in this sector.

DORA legislation requires a pragmatic approach in addition to knowledge: Eraneos delivers both qualities

Operative implementation of requirements

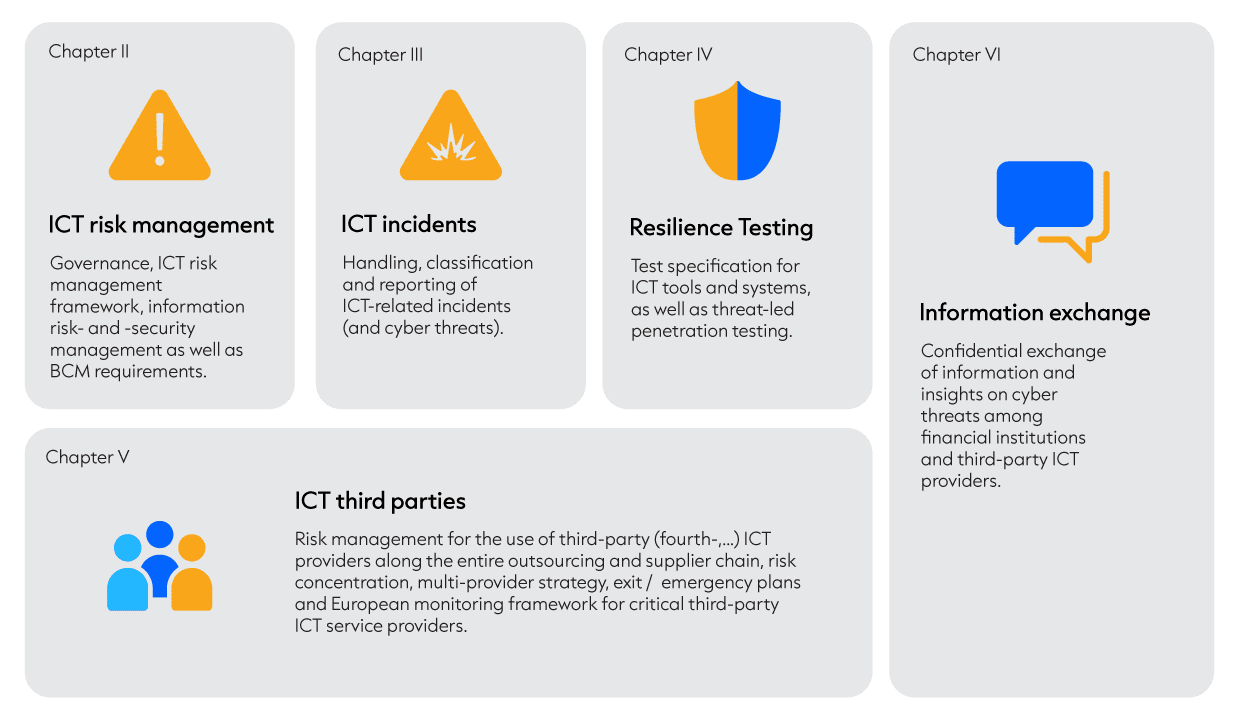

The requirements to be implemented relate to different divisions and therefore involve different organizational units and positions within the company. The main units concerned are IT, information security management, business continuity management and (central) outsourcing management. The directive stipulates implementation on four main areas:

- ICT risk management with IT security, ISM and BCM requirements (chapter II);

- Guidelines on incident management and the reporting of ICT related incidents (chapter III);

- Requirements for testing digital operational resilience (chapter IV);

- Management of third-party risks throughout the entire outsourcing chain (chapter V)

The following chapters define non-mandatory requirements or requirements for the supervisory authorities.

Overview of the 5 focus points of the Digital Operational Resilience Act DORA

Eraneos Gap Analysis Tool

Make sure you are DORA compliant with the Eraneos Gap Analysis tool. We make sure your organization is compliant in two phases – Phase 1 is a Gap Analysis, Phase 2 is Implementation.

Our Impact

We’ve successfully assisted several organizations within the financial services market with meeting the DORA regulations.

Health insurer

Implemented a Gap Analysis for a large health insurer.

Bank

Completed a DORA implementation for a large bank in the Netherlands.

Pension Fund

Completed a DORA Gap Analysis for a Pension fund.

Pension Fund

Gap Analysis and Implementation for a pension fund.

Logistics Insurer

DORA Implementation for a Dutch logistics insurer.

Why Eraneos to help you with your DORA implementation

Implementing DORA is essential for financial institutions to ensure compliance and security. Eraneos is the ideal partner due to our 30 years of experience in the field, as well as market research, benchmarking, and extensive best practices. We operate independently, providing unbiased advice tailored to your needs. With deep expertise in the financial market, particularly in pensions, banking, and insurance, Eraneos offers unparalleled market knowledge and understanding of industry challenges.

We excels in supervising large IT-related transformations and outsourcing projects, providing comprehensive support for IT policies, DORA, risk policies, security, governance, and compliance. As a Great Place to Work focused on social responsibility, Eraneos fosters a motivated and dedicated team. Our global presence, with sister organizations in Switzerland, Germany, and Spain, combines international insights with local expertise. Partnering with Eraneos means leveraging our extensive experience, independence, and commitment to excellence in the financial sector, ensuring a successful DORA implementation.

Get Inspired

Do you want to learn more about DORA? Check out some of the content created by our experts.

DORA – Central Register of Information

Learn how Microsoft’s new Git integration in Power BI transforms collaboration, enabling multiple developers to work on reports and track version history.

Explore this articleIT Transformation

How do you adapt your IT infrastructure, systems, processes and culture to become more agile and innovative as an organization and achieve your goals?

Explore this topic

Let’s create sustainable change together.

Arno IJmker

Partner – Pensions

Financial Services | Pensions

arno.ijmker@eraneos.com +31 20 305 3700 @arnoijmker

Hans Burg

Partner – Insurance

Financial Services | Insurance

hans.burg@eraneos.com +31 20 305 3700 @hansburg

Kishan Ramkisoensing

Partner – Banking

Financial Services | Banking

kishan.ramkisoensing@eraneos.com +31 20 305 3700 @kishanramkisoensing